Analyzing online traffic and making sense of all the data is something growth marketers do every day. After all, we need to understand what’s going on in order to grow the business. Sometimes our assumptions about our online traffic are based on past experiences, sometimes we can support them with data, but quite often they are based on pure logic. But are they really? Over the years we’ve worked with numerous clients and here are the top 5 assumptions which are proven wrong more often than not.

Brace yourself as there are some unexpected insights flying your way.

1) Users searching for a specific product brand will actually buy that brand.

I was so sure this was true that for years I didn’t even bother to think about it. Who would think that users searching for “Nike sneakers” are actually buying Adidas sneakers in the end?! I sincerely hope that I’m not the only one surprised by this. I mean, my whole reputation could be ruined. 🙂 For years, we, digital marketers, have been using Google Paid Search advertising to catch users who are looking for a specific product. Then we try to write a suitable text ad (if possible, by including the search term in the copy) and link the ad to the most specific landing page which should as closely as possible match the user’s intent/search term. Even Google itself is promoting this (by including relevance in its Quality Score calculation). The formula is/was simple: if the user is searching for “Nike sneakers”, include “Nike sneakers” in your ad headline and copy, and link it to a landing page displaying Nike sneakers. We were so wrong. It turns out that quite a large portion of users will actually consider and even buy a product from another brand. Of course, it all depends on the primary brand they were searching for. Some brands are more “stable” and have higher brand loyalty and higher brand stickiness. Others are not so lucky.

How to get the data:

As you can imagine it’s not that simple to get the data. A simple AdWords Campaigns report in Google Analytics will show you your revenue and the number of transactions generated by a specific Campaign/Ad Group (I presume you have a well-organized Google AdWords account), but it won’t disclose which products/brands the user actually bought. Therefore, it’s easy to falsely conclude that my Nike campaign is actually selling lots of Nike sneakers. Even an AdWords Keywords report won’t help.

You can get slightly better insights if you head to the Product Performance report inside Enhance E-commerce, segment your traffic to include only AdWords traffic, and use Product Brand as the Primary Dimension. Then drill-down to a specific brand and use Campaigns as your Primary Dimension. This will enable you to see which campaigns are actually driving the sales of a specific brand.

But we want to see which brands the users acquired by a specific brand actually ended up buying. So it should be the other way around. To do that you first need to create a custom segment which only includes traffic generated by a specific brand.

Now head back to the Product Performance report inside Enhance Ecommerce and use Product Brand as the Primary Dimension.

Our new custom segment disclosed the insights we were looking for. As seen in the example above, only 50% of users that were acquired on Google Search with search terms including “Nike” actually bought a Nike product. Shocking isn’t it?! 😮 I would argue that Nike has a brand stickiness of 50%. Low stickiness is not necessarily bad, but it gives you something to think about.

How to act on these insights:

- First of all, don’t remarket to users with a static copy promoting the brand they were searching for. Establish dynamic remarketing and promote the products and brands they were actually engaging with on the website.

- If stickiness is low for a specific brand, try discovering why that is. Do you have enough products in stock? Are the prices higher?

- Establish RLSA on brands that are “stealing” most of the customers from the primary brand. I’m not saying that you should convince them to purchase the primary brand, but adapt the copy based on the knowledge that these users were actually searching for another brand first.

- For brands with low stickiness include secondary brands as Sitelink extensions on Google Search.

2) Direct Traffic brings the most qualified users

Direct Traffic should represent the traffic from your most loyal users. OK, maybe not loyal, but definitely from users who know you so well that they have memorized your domain and typed it into their browser to reach your website. It’s easy to conclude that these are also your best users (in terms of transactions and conversions). Why else would they bother memorizing your domain? As it turns out, other channels quite often bring more qualified users. Of course, it all depends on your performance on other channels (if you suck in Paid Search, it won’t bring any quality users), but it’s quite common to see channels like Paid Search, Organic Search and Email outperforming Direct.

How to get the data:

There are a couple of ways to analyze channel performance. To stick to the point, we’ll focus on evaluating channels based on how qualified the users they bring are in terms of transactions.

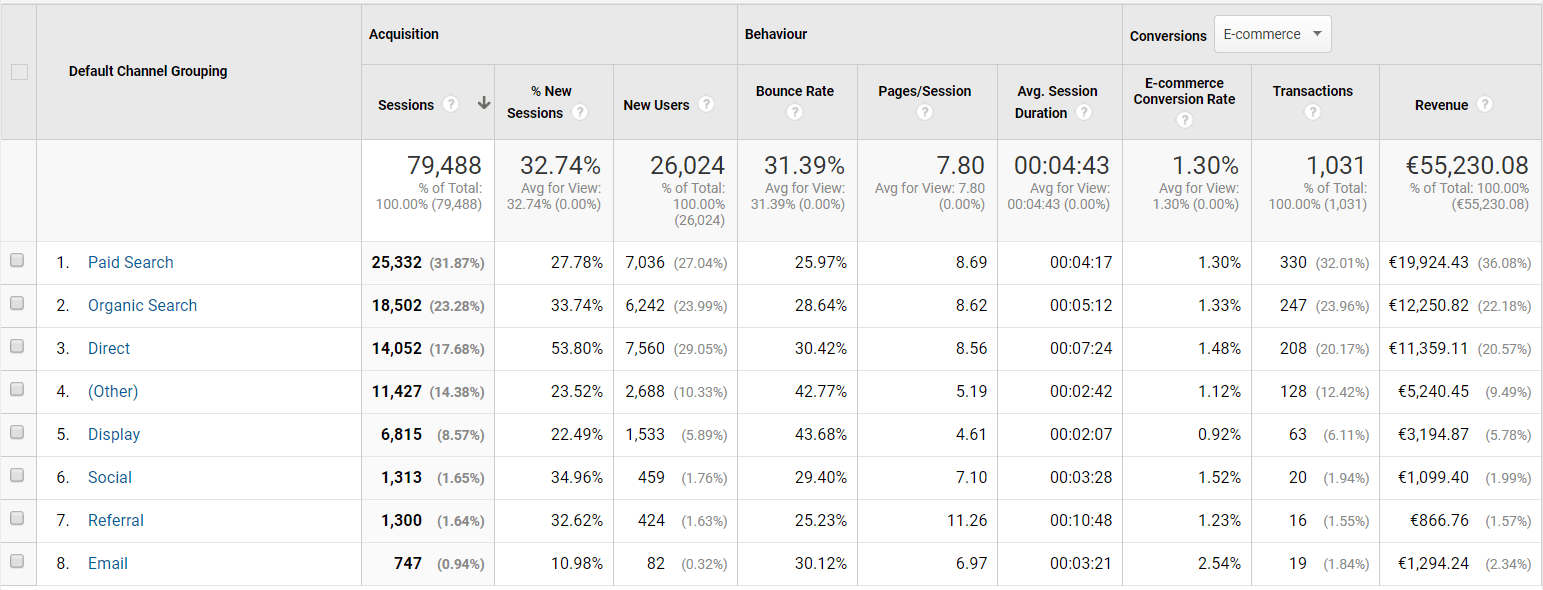

The most obvious way would be to look at the Channels report under Acquisition. Sort by E-commerce Conversion Rate to see which Channels have the highest conversion rate.

In the example above Email surpasses Direct by far. Even Social has a higher E-commerce Conversion Rate. One might argue that these two channels bring a very low number of transactions and that we should only compare high-volume channels. I guess that’s true. In that case, Direct has the highest E-commerce Conversion Rate, but (of course there’s a “but” 🙂 ) the difference in conversion rate between Paid Search, Organic Search and Direct is not statistically significant, meaning we can’t say for sure that Direct brings the best users. But even more importantly, this report doesn’t really give us any insights about all the users who didn’t convert.

To see the quality of users who didn’t convert (and there’s plenty of them – 98,52% to be exact) head over to the Session Quality report (currently in Beta so it might not be available on all properties).

The Session Quality report displays how your sessions are distributed by session quality. Google uses machine learning to calculate Session Quality and Average Session Quality metrics to estimate a user’s proximity to conversion. Users are evaluated for each session, and the resulting proximity to conversion is expressed as a score of 1-100 for each session, with 1 being the farthest from and 100 being the closest to a transaction.

It also displays the average Session Quality for each channel. As seen in the example below, Paid Search and Organic Search have a higher average Session Quality, meaning they bring more qualified users on average. This doesn’t mean they bring more conversions or that the conversion rate is higher, but that users who don’t complete the transaction are closer to completion. You’re also able to drill-down to see the distribution of Session Quality for a specific channel.

People are quite often shocked when they find out that the majority of Direct Traffic has a really low Session Quality. Not only that, Direct Traffic usually has one of the lowest High-Quality Session percentages. How can that be?!

Why is Direct Traffic so low quality?

For a start, you should know that Google Analytics will attribute all sessions from unknown sources to Direct Traffic by default. Thus Direct Traffic represents not only traffic from users who typed your URL directly into their browser but also from other sources (which might and often are bringing very poor-quality users).

Secondly, your “loyal” users might have developed a habit of regularly checking your website for new offers. They’re visiting your website without a clear intention to buy, thus their Session Quality is low. I wouldn’t say that’s a bad thing because when they’ll be ready to buy, their purchase time will be much shorter and the conversion rate will be much higher. It’s always good to have a loyal fan base.

3) Once you go Direct you will always go Direct

We are creatures of habit. Habits help us throughout the day. They simplify our lives. Once we develop a habit we stick to it. That’s the reason why brands are so eager to build a habit of using their product or services. It’s a golden mine for them. Once you have a habit of buying a specific shampoo it’s going to be hard to switch to another brand (remember brand stickiness?). But more often than to products and brands, habits are connected to our behavior. Consider the first things you do when you get out of bed or, more relevant to our case, how you browse the web and search for a product.

Because habits are so closely related to our behavior it’s hard to know which part of user behavior is habitual and which isn’t. Too often we find repeatable patterns in Google Analytics which are not that at all.

I wouldn’t dare to claim that anyone still believes in the one-channel-to-rule-them-all user journey (meaning users will always use only one channel to access your website). After all, multi-channel and omni-channel concepts have been around for years now. It comes naturally to us that users will access the website via different channels like Facebook, Google, Email, Direct, etc.

However, what is shocking is how many of the users who started the purchase journey via Direct Traffic then switched to other channels. In the example below, 60% of the users who started via Direct switched to other channels. In the end, 83% of them nevertheless finished the transaction via Direct. Wait! What? You’re saying that my loyal users, who know the brand well and often visit the website, are actually browsing the web and searching for alternatives on Google? Yes, I am.

All of our research data from lots of different clients and industries show that channel selection (which channels users are using to access the website) is not something habitual. You can’t rely on users to use the same channels all the time. This enforces the idea that you always need to be present on all channels.

As we can’t rely on habits, it’s really important to know how different digital channels are being used through the decision journey. A Cross-Channel Consumer Decision Journey Report offers a simple way to better understand the role of each digital channel.

How to get the data:

Google Analytics offers some predefined multi-channel reports but it’s hard to make any sense out of them. To create a Cross-Channel Report you’ll need to look at the percentage of Assisted and Last Interaction, which start with Display as the First Interaction for every channel. We’ve dedicated a whole article to creating Cross-Channel Reports.

4) Paid Search is the most reliable channel

Since the beginning of time (aka the internet), users and marketers have relied on Search as one of the most reliable and intent-driven channels. We’ve been using it for years to catch users with a high purchase intent, trying to convince them we are the best solution to their problems. Yet in the past few years, things have started to change. The number of searches isn’t increasing anymore. Moreover, generic search is in decline. This could bring lots of trouble to advertisers who are relying on Paid Search. We have seen a decrease in Paid Search revenues of up to 80%!

Brands age. Industries changes. Markets mature. Even in Search.

After spending a fair amount of time researching this phenomenon, we’ve discovered that Brand Maturity plays a significant role in Search. As you can see from the graph below, we can segment each market based on its maturity and each of these segments has a dominant user base, from Innovators at the beginning, through Early and Late Majority at the peak, to Laggards at the end.

Market maturity stages and Paid Search

Markets mature and search queries change. Different users will use different search terms, not only because they have different characteristics (Innovators tend to be younger and more open to change than Laggards), but mainly because there is nothing there at the beginning. You can read more about market maturity in this blog post.

How to act on these insights:

- Be sure to pay attention to market maturity when comparing the YoY results of your Paid Search and when evaluating its performance.

- Think about investing in brand awareness. As markets mature, a strong brand name makes a huge difference and there is no way of surviving without it.

- Also focus on using a wide variety of keywords, including synonyms and keywords describing substitute products, when entering a new market.

5) All Google Search users are pretty much the same

Are you ready for the big revelation? There are 12 types of users! Yes, you read it right, there are 12 types of Google Search users and you should have a different approach for each one of them. Who are they and how to segment them? First we have Behavioral segments, which tell us where on the consumer decision journey we can find our users:

- Recent buyers, users that have recently purchased a product and are now in the post-purchase stage.

- Close to purchase users, are users whose behavior suggests they are in the last stage of the purchase cycle. They’ve either added a product to the basket, entered the checkout process, or their Session Quality is high. Keep in mind that not all users from this segment have necessarily visited your website, so expand your reach with similar audiences.

- In-market users, who are actively researching different products. They are in the research phase, and are not yet ready to buy.

- Qualified users, also known as the Largest Addressable Qualified Audience; these are users who are within your target group but their behavior suggests they’re not actively searching for a new product.

Makes sense, right? The following are Brand Familiarity segments which we use to cross-match our Behavioral segments and create more accurate lists, enabling us to adjust the copy and bidding:

- High-volume buyers are users who make 3+ transactions per year (the number may vary based on the industry and the client).

- All past buyers, users who purchased one or more products in the past but are not high-volume buyers.

- Users familiar to the brand are all users who know the brand but haven’t purchased yet. These might be visitors to your website or any other user who came across your brand in the past.

- New high-quality users have never interacted with your brand before, but based on their behavior we can assume they are highly qualified users.

- New users for whom we have no behavioral data and who are not highly qualified users. They are basically a total mystery to us.

In the end, we are left with 12 highly-targeted segments of Google Search users:

How to act on these insights:

It’s easy to reach every single one of these users if you make relevant remarketing lists combined with Customer Match lists. The trick is to cross-match these segments and adapt your copy, approach and bidding to each one of them. Users who are more familiar with your brand will usually have higher conversion rates, so we can spend more to acquire them.

Additional segmentation by list duration can be applied to any of these 12 segments, generating numerous new segments for you. If some of your initial 12 segments are large enough, try applying Duration segments as well. You can read more recommendations about reaching different types of users here.